Table of Content

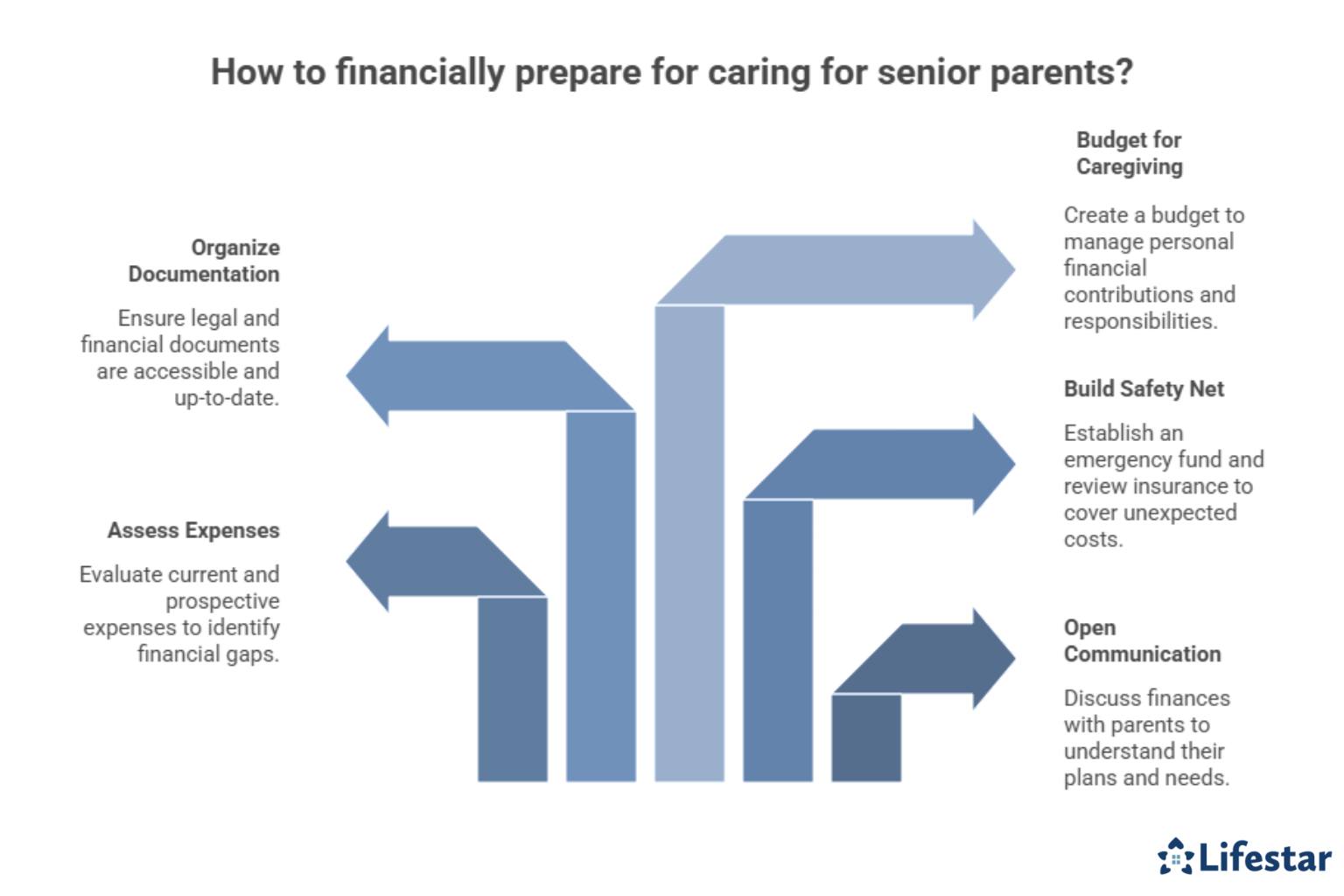

Caring for aging parents is a significant responsibility that can often come with substantial emotional and financial challenges. Financial preparation is key to ensuring your parent’s needs are met while keeping your own financial stability intact. Here are several tips to help you plan effectively.

Open the Lines of Communication

Discussing finances with your parents may feel uncomfortable, but it’s a crucial first step. Start with open-ended respectful questions like “What are your short-term and long-term plans for your health and living arrangements?” or “Do you already have any specific plans in place for financial matters as you age?”

Key points to cover include:

- Understanding their income sources (e.g., pensions, social security, savings, retirement accounts)

- Reviewing existing debts or liabilities

- Evaluating assets such as property or investments that could be utilized later

This conversation lays the foundation for creating a comprehensive financial plan.

Even if your loved ones’ finances are in order, they may be facing other challenges due to changes in health. If you have senior loved ones who need help maintaining a high quality of life while aging in place, reach out to Lifestar Home Care, a leading provider of home care Oklahoma City families can trust. Our caregivers help seniors focus on healthy lifestyle habits such as eating nutritious foods, exercising regularly, and maintaining strong social ties, and we offer mentally stimulating activities that can boost cognitive health and delay the onset of dementia.

Assess Their Expenses & Needs

Take a close look at your parents’ current and prospective expenses, keeping in mind their needs may change over time. Some areas to consider include:

- Healthcare costs – This includes medical bills, prescriptions, regular checkups, and potential long-term care services.

- Housing arrangements – Will your parents age in place, downsize, or move into assisted living? Housing costs could vary greatly depending on the choice.

- Daily living expenses – Groceries, utilities, and other day-to-day essentials should also be factored in.

Use this assessment to identify potential gaps in their finances and start planning for ways to address them. Aging in place can present a few unique challenges for older adults. Some only require part-time assistance with exercise or meal preparation, while others are living with serious illnesses and benefit more significantly from receiving live-in care. Oklahoma City, OK, Lifestar Home Care are leaders in the elderly in-home care industry for good reason. We tailor our care plans based on each senior’s individual needs, our caregivers continue to receive updated training in senior care as new developments arise, and we also offer comprehensive care for seniors with Alzheimer’s, dementia, and Parkinson’s.

Build a Financial Safety Net

Once you know your parents’ needs, it’s time to prepare for unexpected expenses. Setting up a financial cushion can make a world of difference. Consider the following steps:

- Emergency fund – Establish or bolster an emergency fund with savings set aside specifically for unforeseen medical or caregiving expenses. Aim for at least 3–6 months’ worth of expenses.

- Insurance – Review existing health insurance, Medicare, and long-term care insurance policies. If gaps exist, explore coverage options to reduce out-of-pocket costs in the future.

- Government assistance – Research programs like Medicaid or veterans benefits for financial assistance, especially for healthcare and housing.

A proactive financial safety net reduces stress and ensures you’re prepared for sudden changes.

Finances aren’t the only concern for seniors. Health conditions, injuries, and loneliness can significantly impact their quality of life.

Organize Legal & Financial Documentation

Organizing important documentation early is another critical step. Ensure you and your parents have access to essential legal and financial records:

- Power of attorney – Assign a trusted individual with the authority to make financial and healthcare decisions if needed.

- Living will or advance medical directive – Specify your parents’ preferences for medical care and end-of-life decisions.

- Estate planning – Work on wills, trusts, and beneficiary designations to prevent future legal complications.

Consulting an elder law attorney may be helpful to ensure all documentation is comprehensive and legally binding.

Budget for Your Role as a Caregiver

Your caregiving role may come with its own financial commitments. To avoid overextending yourself, create a budget that outlines your contributions. Consider:

- Direct financial support you might provide, like paying for groceries or medical supplies

- Adjustments to your own budget (e.g., reducing discretionary spending to accommodate caregiving needs)

- Opting for shared responsibilities by involving siblings or other family members in caregiving and financial support

By setting clear boundaries and defining your financial role in advance, you’ll be better equipped to balance your personal wellbeing with your caregiving responsibilities.

In addition to help with finances, seniors also often require assistance with daily tasks like cooking, cleaning, and personal care. If you have a senior loved one who needs help maintaining a high quality of life while aging in place, reach out to Lifestar Home Care, a leading provider of home care service families can rely on. All of our caregivers are bonded, licensed, and insured, there are no hidden fees, and we never ask our clients to sign long-term contracts. Reach out to us at Lifestar Home Care if you need compassionate professional care for your loved one. Call one of our friendly Care Managers today.