Table of Content

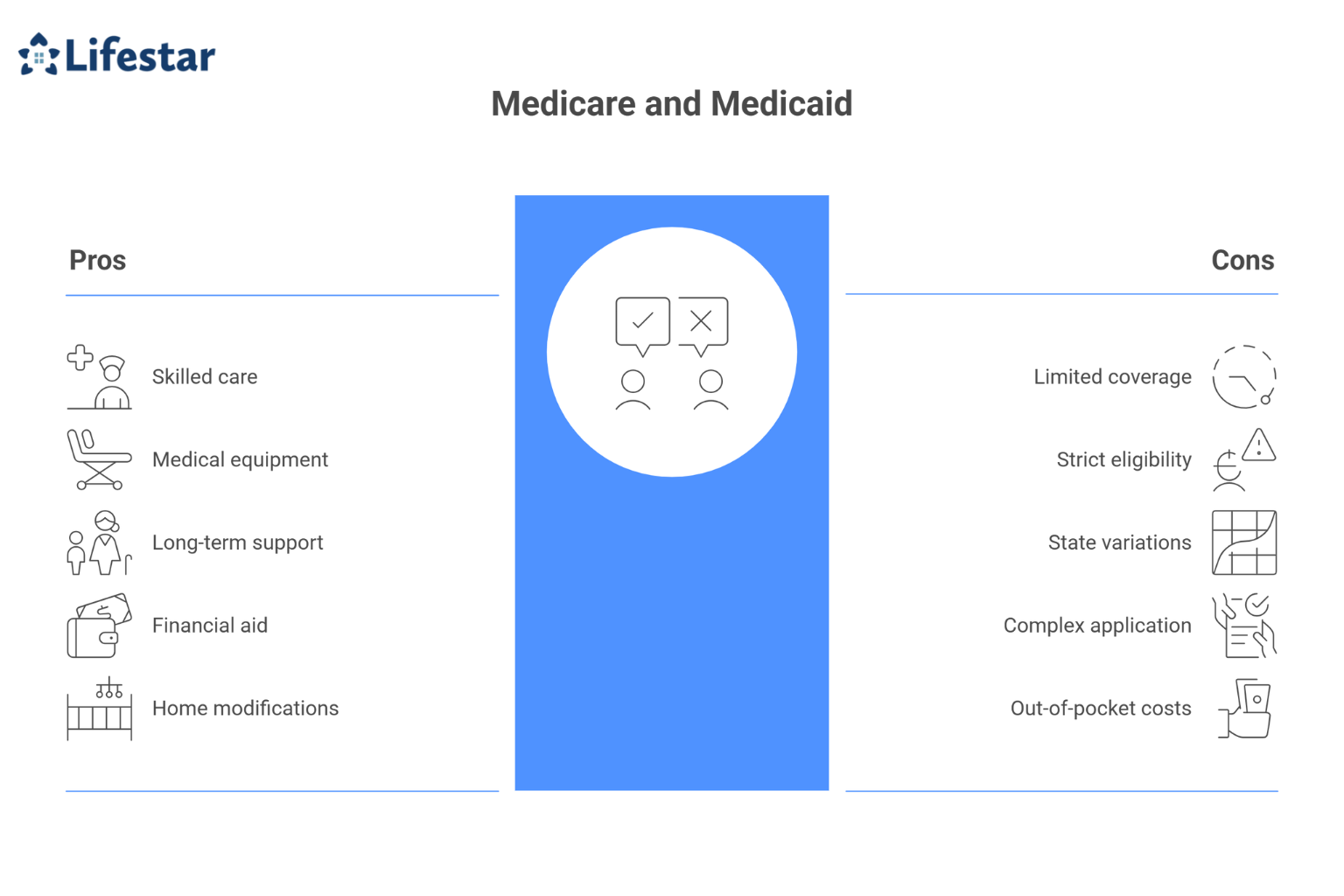

Navigating healthcare coverage options can feel overwhelming when you’re caring for an aging loved one. Understanding the differences between Medicare and Medicaid—and how they apply to home care services—helps you make informed decisions about your family member’s healthcare needs.

What Medicare Covers for Home Care Services

Medicare provides limited coverage for home healthcare services, but only under specific circumstances. To qualify for Medicare home health benefits, your loved one must be housebound, under a doctor’s care, and require skilled nursing care or therapy services.

Medicare Part A covers:

- Skilled nursing care on a part-time basis

- Physical, occupational, and speech therapy

- Medical social services

- Home health aide services (when receiving skilled care)

- Durable medical equipment like wheelchairs or hospital beds

However, Medicare doesn’t cover:

- 24-hour care at home

- Personal care services like bathing, dressing, or meal preparation

- Homemaker services such as cleaning or laundry

- Prescription drug delivery

These coverage limitations mean many families need to explore additional options for comprehensive home care support.

Choosing the right Medicare plan isn’t the only issue seniors may have to face. Living alone at home in the golden years can present a few unique challenges. Trust at-home care professionals to help your senior loved one maintain a higher quality of life while he or she lives with an illness and performs the daily tasks of living.

How Medicaid Differs from Medicare

While Medicare focuses on medical care, Medicaid offers broader support for long-term care services. Medicaid is a joint federal and state program that provides healthcare coverage for individuals with limited income and resources

Key differences include:

- Eligibility – Medicare is available to most people 65 and older, while Medicaid has strict income and asset requirements.

- Coverage scope – Medicaid covers many services Medicare doesn’t, including personal care assistance.

- State variations – Each state administers its own Medicaid program with different benefits and eligibility rules.

- Cost sharing – Medicaid typically has little to no cost sharing for covered services.

Understanding these distinctions helps caregivers determine which program might provide the most appropriate coverage for their situation.

Every senior has different needs when aging in place. Some simply need occasional assistance with household chores, while others may be managing serious illnesses and require more extensive live-in care. Oklahoma City seniors can count on Lifestar Home Care to provide the in-home care they need and deserve.

Medicaid Home and Community-Based Services

Medicaid’s Home and Community-Based Services (HCBS) waivers allow states to provide long-term care services in home settings rather than institutional care. These programs specifically support seniors who want to remain in their homes while receiving necessary care.

HCBS waivers may cover:

- Personal care assistance with daily activities

- Homemaker services, including light housekeeping

- Adult day health services

- Respite care for family caregivers

- Home modifications for accessibility

- Transportation to medical appointments

Each state designs its own waiver programs, so available services vary significantly by location. Contact your state’s Medicaid office or Area Agency on Aging to learn about specific programs in your area.

Eligibility Requirements and Application Process

Both Medicare and Medicaid have specific eligibility requirements that caregivers should understand before applying for benefits.

Medicare eligibility requirements:

- Age 65 or older, or disabled for 24 months

- U.S. citizenship or legal permanent residency

- Enrollment in Medicare Parts A and B

- Physician certification of housebound status for home health services

Medicaid eligibility requirements:

- Income and asset limits (vary by state)

- U.S. citizenship or qualified immigrant status

- State residency requirements

- Medical necessity determination for long-term care services

The application process involves gathering extensive documentation, including:

- Financial records and tax returns

- Medical records and physician statements

- Proof of citizenship and residency

- Asset verification documents

Working with a social worker or elder law attorney can help you navigate the complex application process and ensure all requirements are met.

Planning Ahead for Long-Term Care Costs

Many families underestimate the costs associated with long-term care services. Even with Medicare or Medicaid coverage, out-of-pocket expenses can be substantial.

Consider these planning strategies:

- Research long-term care insurance options early.

- Explore state-specific programs that may provide additional benefits.

- Understand the “spend-down” process for Medicaid eligibility.

- Consider legal strategies to protect assets while qualifying for benefits.

- Investigate veteran benefits if applicable.

Planning ahead allows families to make informed decisions about care options while preserving financial resources for other needs.

Seniors can face a variety of challenges as they age, many of which can be mitigated with the help of professional in-home caregivers who provide high-quality home care. Oklahoma City families trust Lifestar Home Care to help their elderly loved ones age in place safely and comfortably. Call us today to create a customized in-home care plan.