![]()

Table of Content

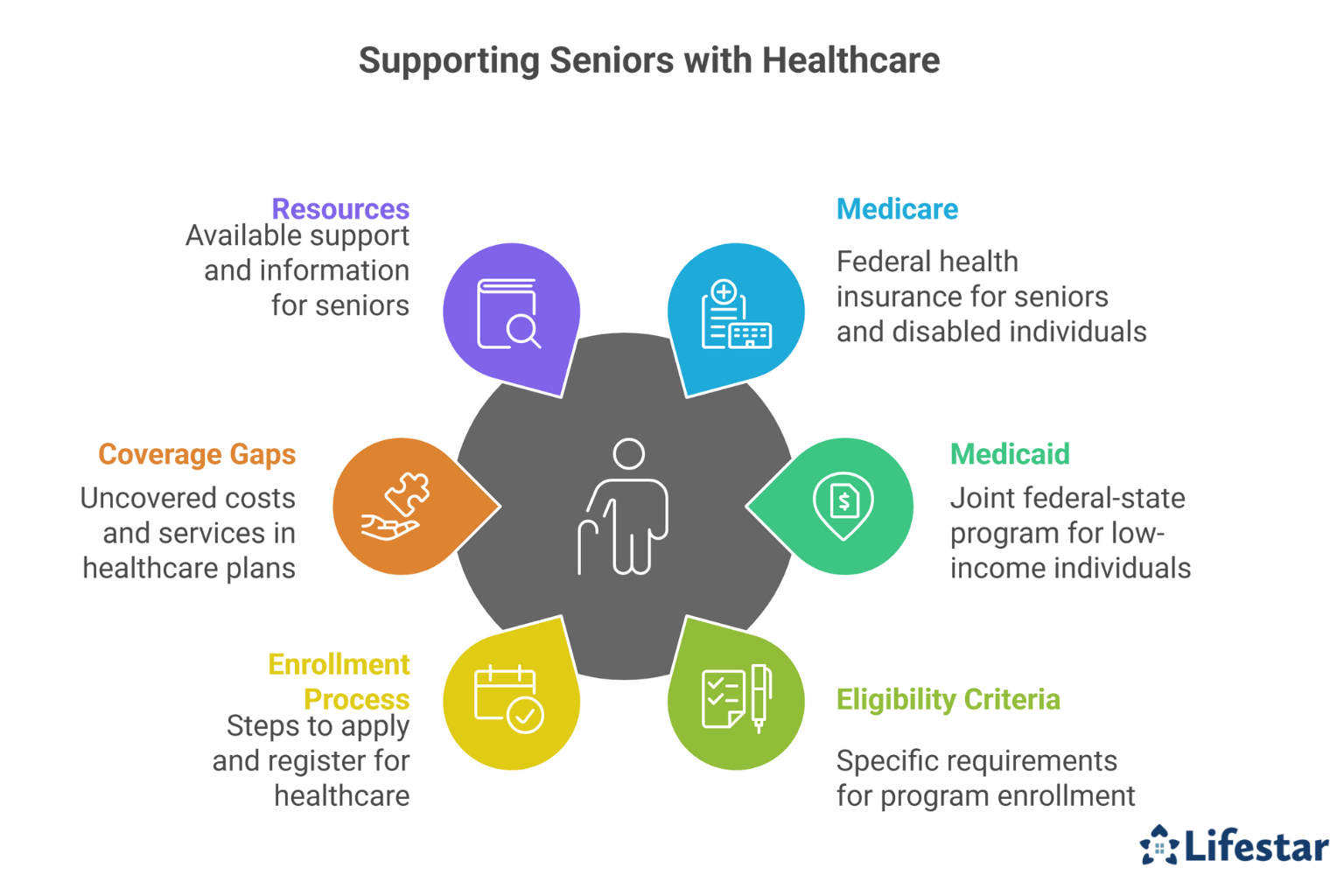

Understanding Medicare and Medicaid can feel overwhelming, especially when you’re trying to help a senior loved one access the care he or she needs. These programs have different eligibility requirements, coverage options, and enrollment periods that can be confusing to navigate. This guide will walk you through the key challenges and provide practical steps to help you support your loved one effectively.

What’s the Difference between Medicare and Medicaid?

Many people confuse Medicare and Medicaid, but they serve different purposes:

- Medicare is a federal health insurance program primarily for people aged 65 and older or those with certain disabilities. It covers hospital stays, doctor visits, and prescription drugs.

- Medicaid is a joint federal and state program that provides health coverage to low-income individuals, including seniors who meet specific financial criteria.

Some seniors qualify for both programs (called “dual eligibility”), which can provide more comprehensive coverage but also adds complexity to the enrollment process.

How to Determine Eligibility

For Medicare:

- Your loved one is generally eligible at age 65 if he or she (or his or her spouse) paid Medicare taxes while working.

- Younger individuals may qualify if they have certain disabilities or conditions like end-stage renal disease (ESRD).

For Medicaid:

- Eligibility varies by state but typically depends on income, assets, and medical needs.

- Many states have expanded Medicaid under the Affordable Care Act, broadening eligibility.

- Seniors may qualify for long-term care benefits if they meet both financial and functional requirements.

To check eligibility, contact your state’s Medicaid office or visit Medicare.gov. A local State Health Insurance Assistance Program (SHIP) counselor can also provide free personalized guidance.

Navigating Medicare and Medicaid isn’t the only age-related issue seniors may have to face. Many older adults are choosing to age in place, and some need a helping hand to continue living at home safely and comfortably. Luckily, there is professional home care Oklahoma City seniors can trust and rely on.

How to Enroll in Medicare and Medicaid

Medicare enrollment:

- The initial enrollment period runs for seven months, starting three months before your loved one turns 65.

- Missing this window can result in late enrollment penalties.

- Part A (hospital insurance) is usually free, while Part B (medical insurance) requires a monthly premium.

- Consider whether your loved one needs Part D (prescription drug coverage) or a Medicare Advantage Plan (Part C).

Medicaid enrollment:

- There’s no specific enrollment period—eligible individuals can apply anytime.

- Applications are submitted through your state’s Medicaid agency.

- Be prepared to provide documentation of income, assets, medical expenses, and citizenship.

Keep copies of all paperwork and follow up regularly to ensure applications are processed without delays.

Some Medicare Advantage plans include coverage for in-home respite care. Living independently is important for seniors who want to maintain a high quality of life. For some, this simply means receiving help with tasks that have become more challenging to manage over time. Even when families have the best intentions, they may not have the time to provide the care their elderly loved ones need and deserve. If your loved one needs help for a few hours a day or a few days a week, reach out to Lifestar Home Care, a trusted provider of respite care in Oklahoma City.

Managing Coverage Gaps and Costs

Even with Medicare and Medicaid, some costs may not be fully covered:

- Medicare coverage – Long-term nursing home care, most dental care, eye exams for glasses, and hearing aids aren’t covered.

- Out-of-pocket costs – Deductibles, copayments, and coinsurance can add up quickly.

- Medigap policies – These supplemental insurance plans can cover gaps in Original Medicare but aren’t available to those with Medicare Advantage.

If your loved one qualifies for Medicaid in addition to Medicare, many of these gaps will be filled. Medicaid can pay Medicare premiums, deductibles, and copayments for dual-eligible beneficiaries.

Seeking Help and Resources

You don’t have to navigate this alone. Several resources are available to assist you:

- SHIP (State Health Insurance Assistance Program) – Free one-on-one counseling on Medicare and related insurance issues

- Eldercare Locator – A nationwide service connecting families to local resources (call 1-800-677-1116)

- Medicare.gov – Official site with plan comparison tools and enrollment information

- Medicaid.gov – State-specific information on eligibility and benefits

- Area Agency on Aging (AAA) – Local agencies offering support services for seniors and caregivers

Consider consulting with an elder law attorney if your loved one has complex financial situations or needs help with estate planning related to Medicaid eligibility.

Some seniors only require help with a few daily tasks so they can maintain their independence. However, those living with serious illnesses may need more extensive assistance. Luckily, there is professional live-in care for Oklahoma City seniors. Home can be a safer and more comfortable place for your loved one to live with the help of an expertly trained and dedicated around-the-clock caregiver. We will work with you to create a customized home care plan that’s suited for your loved one’s unique needs. Call the Lifestar Home Care team today.